The 100-year-old railway Mexico hopes will rival the Panama Canal | The Week

The Panama Canal has powered global trade for over a hundred years. There's no better way to transport goods from the Atlantic Ocean to the Pacific — but maybe, that's about to change. Mexico is about to open a new project: the Interoceanic Corridor of the Isthmus of Tehuantepec. Seems like just the thing for the giant container ships, but no help to the US Navy for shifting ships. But what is this thing? And will it replace the Panama Canal? We'll still need it for the Navy. Mexico and Canada are attempting to tie this rail line into a continenal rail network running up through Texas and the center of the 3 countries, bypassing ports on the east and west coasts.

EL CIIT

The Corredor Interoceánico- Istmo de Tehuantepec (CIIT) has been a subject of ongoing development and investment in Mexico:

Total Cost:

- Official estimates: As of October 30, 2023, Mexican authorities stated that the government had invested "a little over 70 billion pesos" on the Corridor's infrastructure. This translates to roughly $3.5 billion USD.

- Uncertainties: Some sources suggest the total cost could be higher, depending on factors like fluctuations in material prices, unforeseen challenges, and the scope of future phases.

Funding Sources:

- Mexican government: The primary source of funding is the Mexican government, allocating resources from various ministries and public institutions.

- Private investment: The program aims to attract private investment through the creation of 10 industrial parks in the Isthmus area. However, the actual amount of private contributions and their timeline remain unclear.

Cost of Use and Capacity:

- Current information: There's limited information available regarding the specific tolls or fees associated with using the CIIT once it's fully operational. This may also depend on the type of cargo and mode of transportation (rail, maritime, etc.).

- Capacity expectations: Initial projections point to a potential capacity of 30 million tons per year, expressed in Twenty-foot Equivalent Units (TEUs). However, achieving this will depend on the completion of various infrastructure upgrades and efficient logistics management.

Important notes:

- The CIIT is still under development, and the final costs, funding breakdown, and specific details about cost of use and capacity might change depending on its evolution.

- It's crucial to consider ongoing economic factors and potential adjustments to the program as more information becomes available.

Logistics Platform of the Interoceanic Corridor of the Isthmus of Tehuantepec

Taking advantage of the strategic location of the

Isthmus of Tehuantepec, in the narrowest space in North America, the

Interoceanic Corridor of the Isthmus of Tehuantepec creates a multimodal

logistics platform that connects the Pacific Ocean with the Atlantic

Ocean.

These actions promote the development of Southern Mexico with a comprehensive, sustainable and inclusive vision.

Ports

The logistics platform integrates the Ports of Salina Cruz, Coatzacoalcos, Dos Bocas and Puerto Chiapas. They have access to the southern United States, Europe, America and Asia, they are the link points between the Pacific and Atlantic oceans, facilitating commercial exchange at a national and international level.

By linking with a network of more than 1,200 km of railways, roads and airports, they optimize logistics, generate opportunities and strengthen the region's strategic position in the world.

Railways

The Isthmus of Tehuantepec Railway has more than 1,200 km of railway lines, which connect the states of Chiapas, Oaxaca, Tabasco and Veracruz. They facilitate cargo transportation, allow interoceanic transit and the departure of local production, they also incorporate passenger services, offering comprehensive connectivity.

It connects with the national railway network, the Mayan Train, North America and Central America, which drives economic development and regional logistics efficiency.

Polos de Desarrollo del Bienestar

Along the railways that connect the Pacific Ocean with the Atlantic, 10 Development Poles will be distributed, which will have ideal conditions for investment, the installation of industries and will enhance the productive capacities of the region.

Companies will have fiscal and non-fiscal incentives, and a favorable business environment, in order to strengthen their competitiveness and boost the regional economy.

Among the vocations of the Poles are the electrical and electronic industries, automotive, auto parts and transportation equipment, agribusiness, medical devices, pharmaceuticals and petrochemicals, among others.

The CIIT will connect Mexico with:

Mexico is a country with an ideal location for business, being a natural bridge between the Atlantic and the Asia-Pacific region thanks to its extensive coastline.

It is a market with great potential, human capital, a solid and open economy and a competitive business environment.

The Isthmus of Tehuantepec, with 300 km of distance between the Pacific Ocean and the Gulf of Mexico, provides a strategic position for interoceanic transportation and the departure of products to the continent and the world.

Download the Information Brochure here

Calgary-based CPKC railway pursues the Corredor Interoceánico megaproject in Mexico - Peace Brigades International-Canada

The Canadian Pacific Railway (CPR) company, rebranded as CPKC this past April, is involved in a megaproject variously called the Interoceanic Corridor of the Isthmus of Tehuantepec, the Trans-Isthmus Corridor, and the Tehuantepec isthmus rail corridor.

In Spanish it is known as Corredor Interoceánico del Istmo de Tehuantepec (CIIT).

Railway Age reports:

“Under the supervision of Mexico’s Secretariat of the Navy, the 188-mile (303 km) CIIT is being built to connect the Pacific and Atlantic Oceans with a mixed-used (freight and passenger) railroad crossing the Isthmus of Tehuantepec from Coatzacoalcos, Veracruz to Salina Cruz, Oaxaca on mostly long-neglected right-of-way. The project also includes modernization and growth of the ports at Coatzacoalcos and Salina Cruz, and of the Minatitlán and Salina Cruz oil refineries in southern Mexico. It also plans to attract private investment through creation of 10 industrial parks in the Isthmus area.”

Mexico Business News also adds:

“Canadian Pacific Kansas City (CPKC) started the feasibility study for a passenger train to connect Mexico City and Queretaro, two important industrial and business poles in the Central-Bajio region. During a conference, Oscar del Cueto, President, CPKC, reported that the company will start the economic feasibility study, which is expected to be delivered in 1H24 [the first quarter of 2024]. Currently, CPKC holds the track concession for cargo operations, but not for passenger transport.”

And El Economista notes:

“Canadian Pacific Kansas City, he added, committed to deliver the study to the current federal government (2018-2024), in order to deliver a portfolio of projects to the new administration (2024-2030). The document will also study the feasibility of it being a public, private or shared investment.”

Test run on September 17

The CIIT is expected to undergo a “supervised test run” on September 17.

According to PasantesDF: “This locomotive with 10 hoppers with cement and two tanks with dangerous material (hydrofluoric acid), is the first machine that travels the tracks from Veracruz to Oaxaca.”

Human rights concerns

Last month, the Peace Brigades International-Mexico Project participated in a Civilian Observation Mission on the CIIT.

Significantly, Proceso reported: “During its three-day tour [July 25-27], the Civilian Observation Mission recorded human rights violations, framed in the Interoceanic Corridor of the Isthmus megaproject, against members of indigenous peoples and communities, most of which involve the Navy and the National Guard.”

La Jornada has further reported: “The most worrying thing, [the civilian observation mission] said, is that there has been an increase in attacks this year and the integrity of defenders who resist this mega-project is at risk.”

The joint statement from the observation mission can be read here.

It notes: “Among the authorities responsible for the human rights violations identified during the mission are the National Guard, the Navy, the Sedena [the Mexican Secretariat of National Defense], [and] the State Police…”

The Canadian government

On May 20, Mexican Secretary of Economy Raquel Buenrostro met with Canadian Minister of International Trade Mary Ng and Industry Minister François-Philippe Champagne, along with US Secretary of Commerce Gina Raimondo, in Washington, DC to promote the Interoceanic Corridor of the Isthmus of Tehuantepec.

Further reading: Extension of The National Dream railway has implications for Indigenous land defenders opposing megaproject in Mexico (July 30, 2023).

Comparison with Panama Canal

Determining the exact number of Panamax ships the Panama Canal can handle under nominal conditions requires considering several factors and understanding different capacity metrics:

Capacity Metrics:

- Net Canal Tonnage (NCCT): This reflects the amount of cargo a specific ship can carry through the canal, calculated based on a complex formula and specific characteristics.

- Panamax Ship Sizes: As mentioned earlier, two primary Panamax sizes exist:

- Original Panamax: 5,000-6,000 TEU capacity

- New Panamax: 12,000-13,000 TEU capacity

- Daily & Annual Transit Estimates: The Panama Canal Authority (ACP) uses these metrics to communicate capacity.

Nominal Conditions:

- This implies average weather, efficient traffic flow, and smooth operations without unexpected closures or delays.

Considering these factors:

- The daily average for original Panamax ships under nominal conditions is around 14-15 transits.

- For New Panamax ships, the average is closer to 8-10 transits per day.

Annual estimates:

Multiplying the daily average by 365 (assuming no closures) would give a theoretical annual capacity of:- 5,110-5,475 for original Panamax ships.

- 2,920-3,650 for New Panamax ships.

Panamax ships come in two general size categories:

- Original Panamax: Designed for the Panama Canal's original dimensions, with a capacity of 5,000-6,000 TEUs and a DWT of 65,000-80,000 tons.

- New Panamax: Built after the Panama Canal expansion in 2016, with a larger capacity of 12,000-13,000 TEUs and a DWT of 120,000 tons.

Therefore, depending on the type of Panamax ship, the capacity can range from 5,000 to 13,000 TEUs.

To calculate the annual TEU and tonnage limits for a scenario of 5,110-5,475 original Panamax ships, some additional information is needed:

- Average TEU per ship: The capacity of original Panamax ships can range from 5,000 to 6,000 TEUs. Knowing the average TEU capacity you're using is crucial for accurate conversion.

- Average container weight: Different cargo types have varying weights, impacting the conversion from TEUs to tons. Specifying the average weight per TEU you're considering will provide a more accurate estimate.

Max TEU Limit:

Multiply the annual ship limit (5,110-5,475) by the average TEU per ship. For example, with an average of 5,500 TEUs per ship:

- Lower limit: 5,110 ships * 5,500 TEUs/ship = 28,055,000 TEUs

- Upper limit: 5,475 ships * 5,500 TEUs/ship = 29,962,500 TEUs

Max Tonnage Limit:

- Multiply the annual ship limit by the average TEU per ship.

- Multiply the result by the average container weight (e.g., 8 tons/TEU).

For example, with an average of 5,500 TEUs per ship and 8 tons/TEU:

- Lower limit: 28,055,000 TEUs * 8 tons/TEU = 224,440,000 tons

- Upper limit: 29,962,500 TEUs * 8 tons/TEU = 239,700,000 tons

Compare this with CIIT:

- Capacity expectations: Initial projections point to a potential capacity of 30 million tons per year depending on the completion of various infrastructure upgrades and efficient logistics management. So it could offload about 8% of the Panama capacity, and would be a best fit for container ships. So the conclusion is that it will supplement, but not replace the Canal.

The 100-year-old railway Mexico hopes will rival the Panama Canal | The Week

The Mexican government is reviving a century-old railway line between the Gulf of Mexico and the Pacific Ocean, in the hope that the route can one day rival the Panama Canal.

The restoration is part of a "bold bid to steal container traffic" away from the waterway, said the Financial Times.

The project "seeks to capitalise on multinationals' desire to be closer to the US" as well as the periods of low water levels in the Panama Canal as the region suffers "increasingly frequent droughts", said the paper.

A new route for international freight

The revival of the railway line means that a ship could "unload its cargo from one side, send it by rail across the Isthmus, and reload it back onto another ship on the other side", thereby providing a new route through which international freight could flow, explained Mexico News Daily.

Originally part of the Tehuantepec line, the railway was first built for the government of dictator Porfirio Diaz and was inaugurated in 1907, before the Mexican Revolution and the opening of the Panama Canal "devastated business", said the FT.

The $2.8 billion project has been "buoyed" by Mexico's increasingly important trading relationship with the US; the country "surpassed China this year to become the US's top trading partner", said The Daily Upside. Given that America's relationship with China remains "decidedly frosty", Mexico can "feel secure in its new position for a while longer".

Droughts are also putting pressure on the canal. Last year the major shipping route, which relies on fresh water for its operation, faced its worst drought on record, causing significant delays.

Operators were forced to reduce the number of ships which passed through the canal from an average of 40 to 32 in order to save water, with each shipping vessel requiring some "200 million litres of freshwater to move through the canal's locks", said Euronews.

It is here that Mexico has spied its most significant opportunity; the government is "bullish" about the new rail route's prospects, as it will offer "proximity to the US and a transit time of 6.5 hours excluding loading time – less than the eight to 10 hours it takes on the 80km canal", said the FT.

Mexico's Secretary of Economy Raquel Buenrostro told the paper that Mexico's investment in railway infrastructure was "a real and increasingly important alternative", as the world faces increasing changes due to the climate crisis. In July, the minister said the trade corridor could account for as much as 5% of Mexico's GDP, reported Mexico News Daily.

A true alternative to Panama Canal?

There are doubts.

In a news conference the canal's director, Ricaurte Vásquez Morales, said: "Definitely the Mexican solution could be a potential threat to the Panamanian operation," but he added a replacement route would only be needed "if we were in a situation where there is no water at all, and we do not anticipate that".

Another major problem is the train route's capacity. Its maximum annual cargo capacity would be about 10.5% of the total amount of goods carried through the Panama Canal in 2022, according to calculations from the FT.

Canadian Pacific and Kansas City Southern Agree to Combine to Create the First U.S.-Mexico-Canada Rail Network | The Ritz Herald

Canadian Pacific Railway Limited (TSX: CP) (NYSE: CP) (“CP”) and Kansas City Southern (NYSE: KSU) (“KCS”) announced they have entered into a merger agreement, under which CP has agreed to acquire KCS in a stock and cash transaction representing an enterprise value of approximately USD$29 billion, which includes the assumption of $3.8 billion of outstanding KCS debt. The transaction, which has the unanimous support of both boards of directors, values KCS at $275 per share, representing a 23% premium, based on the CP and KCS closing prices on March 19, 2021 (and $270 per share, representing a 26% premium, based on the respective CP and KCS 30-day volume weighted average prices (“VWAP”)).

Following the closing into a voting trust, common shareholders of KCS will receive 0.489 of a CP share and $90 in cash for each KCS common share held.

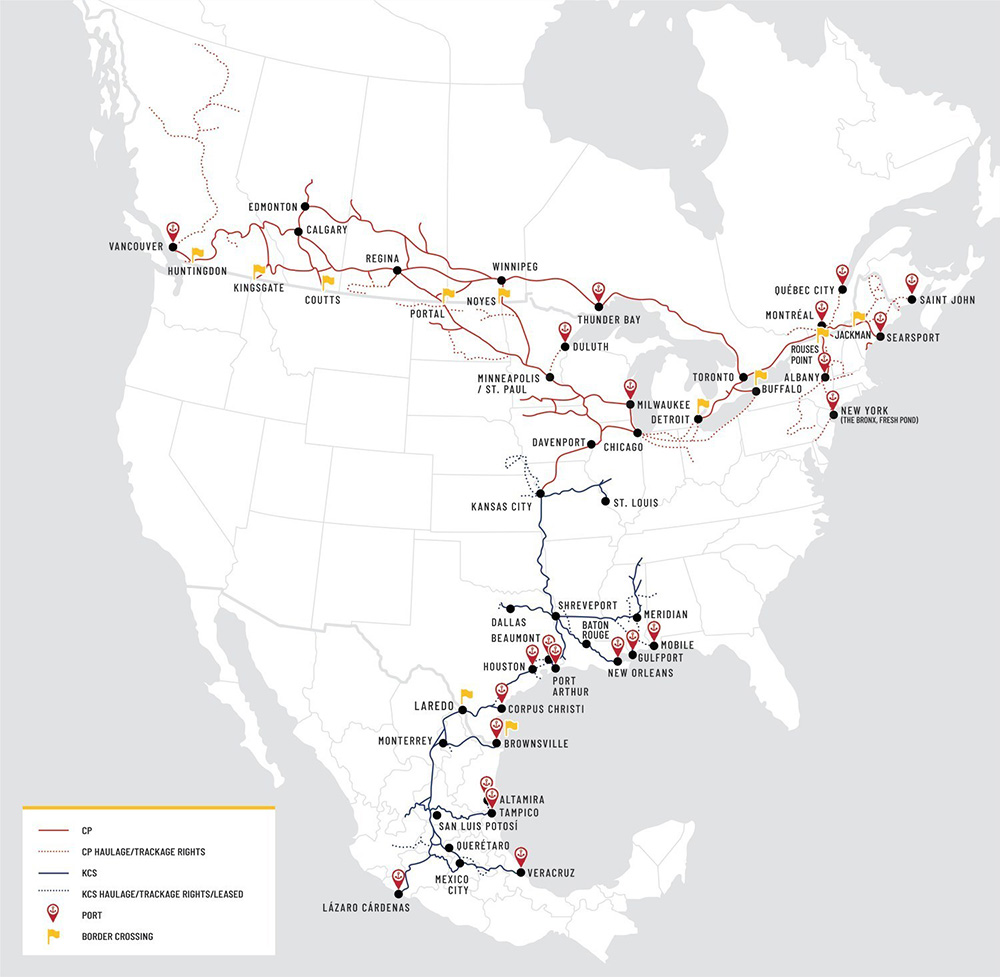

Following final approval from the Surface Transportation Board (“STB”), the transaction will combine the two railroads to create the first rail network connecting the U.S., Mexico, and Canada. Joining seamlessly in Kansas City, Mo., in America’s heartland, CP and KCS together will connect customers via single-network transportation offerings between points on CP’s system throughout Canada, the U.S. Midwest, and the U.S. Northeast and points on KCS’ system throughout Mexico and the South Central U.S.

The combined network’s new single-line offerings will deliver dramatically expanded market reach for customers served by CP and KCS, provide new competitive transportation service options, and support North American economic growth. The transaction is also expected to create jobs across the combined network. Additionally, efficiency and service improvements are expected to achieve meaningful environmental benefits.

Combined Network Map: Creating the First U.S.-Mexico-Canada Rail Network. © Canadian Pacific

While remaining the smallest of six U.S. Class 1 railroads by revenue, the combined company will be a much larger and more competitive network, operating approximately 20,000 miles of rail, employing close to 20,000 people and generating total revenues of approximately $8.7 billion based on 2020 actual revenues.

“This transaction will be transformative for North America, providing significant positive impacts for our respective employees, customers, communities, and shareholders,” said CP President and Chief Executive Officer Keith Creel. “This will create the first U.S.-Mexico-Canada railroad, bringing together two railroads that have been keenly focused on providing quality service to their customers to unlock the full potential of their networks. CP and KCS have been the two best performing Class 1 railroads for the past three years on a revenue growth basis.”

“The new competition we will inject into the North American transportation market cannot happen soon enough, as the new USMCA Trade Agreement among these three countries makes the efficient integration of the continent’s supply chains more important than ever before. Over the coming months, we look forward to speaking with customers of all sizes, and communities across the combined network, to outline the compelling case for this combination and reinforce our steadfast commitment to service and safety as we bring these two iconic companies together,” said Mr. Creel.

“KCS has long prided itself in being the most customer-friendly transportation provider in North America,” said KCS President and Chief Executive Officer Patrick J. Ottensmeyer. “In combining with CP, customers will have access to new, single-line transportation services that will provide them with the best value for their transportation dollar and a strong competitive alternative to the larger Class 1s. Our companies’ cultures are aligned and rooted in the highest safety, service and performance standards.”

“Importantly, KCS employees will benefit from being part of a truly North American continental enterprise, which creates a strong platform for revenue growth, capital investment, and future job creation. Customers, labor partners, and shareholders will all benefit from the inherent strengths of this combination, including attractive synergies and complementary routes,” said Mr. Ottensmeyer.

Mr. Creel and Mr. Ottensmeyer concluded, “We have been champions for the environment recognizing the important role rail plays in lowering overall transportation emissions. This combination advances our shared science-based pledges in-line with the Paris Agreement to improve fuel efficiency and lower emissions in support of a more sustainable North American supply chain.”

Transaction to Expand Options and Efficiencies for Customers

The combination will provide an enhanced competitive alternative to existing rail service providers and is expected to result in improved service to customers of all sizes. Grain, automotive, auto-parts, energy, intermodal, and other shippers, will benefit from the increased efficiency and simplicity of the combined network, which is expected to spur greater rail-to-rail competition and support customers in growing their rail volumes.

Following final regulatory approval, a single integrated rail system will connect premier ports on the U.S. Gulf, Atlantic and Pacific coasts with key overseas markets. The combination of CP and KCS networks will offer unprecedented reach via new single-line hauls across the combined company’s continent-wide network.

Importantly, no customer will experience a reduction in independent railroad choices as a result of the transaction. Additionally, with both companies’ focus on safety and track records of operational excellence, customers will benefit from a seamless integration of the two systems without service disruption.

CP and KCS interchange and operate an existing shared facility in Kansas City, Mo., which is the one point where they connect. This transaction will alleviate the need for a time consuming and expensive interchange, improving efficiency and reducing transit times and costs. The combination also will allow some traffic between KCS-served points and the Upper Midwest and Western Canada to bypass Chicago via the CP route through Iowa. This will improve service and has the potential to contribute to the reduction of rail traffic, fuel burn, and emissions in Chicago, an important hub city.

Improving Highway Traffic, Environmental Sustainability, and Safety

In addition to providing new competition against other railroads, the new single-line routes made possible by the transaction are expected to shift trucks off crowded U.S. highways, yielding reduced highway traffic, lower emissions, and less need for public investments in road and highway bridge repairs. In the Dallas to Chicago corridor alone, the synergies created by this combination are expected to result in meaningful reduction in truck traffic on publicly funded highways.

Rail is four times more fuel efficient than trucking, and one train can keep more than 300 trucks off public roads and produce 75 percent less greenhouse gas emissions. CP is committed to sustainability and is currently developing North America’s first line-haul hydrogen-powered locomotive.

CP and KCS operational expertise and track records as PSR railroads, coupled with the hand-in-glove fit of the two networks, will help ensure a smooth, safe and efficient combination of the two railroads. In combination with KCS, CP will continue to build on its record as North America’s safest Class 1 railroad for 15 consecutive years based on Federal Railroad Administration-reportable train accident frequency.

Creating Value for KCS and CP Shareholders

Following the closing into a voting trust, common shareholders of KCS will receive 0.489 of a CP share and $90 in cash for each KCS common share held. Preferred shareholders will receive $37.50 in cash for each KCS preferred share held. The fixed exchange ratio implies a price for KCS of $275 per share, representing a 23% premium, based on the CP and KCS closing prices on March 19, 2021 (and $270 per share, representing a 26% premium, based on the respective CP and KCS 30-day volume weighted average prices (“VWAP”)).

Immediately following the closing into trust, KCS common shareholders are expected to own 25 percent of CP’s outstanding common shares, providing the ability to participate in the upside of both companies’ growth opportunities. Following final STB approval, KCS shareholders will additionally participate in the realization of synergies resulting from the combination.

By accelerating the combined growth strategies of the two fastest-growing Class 1s with new efficiencies for customers and improved on-time performance under their respective PSR programs, the combined company under CP’s control is expected to create annualized synergies of approximately $780 million over three years.

The combination is expected to be accretive to CP’s adjusted diluted EPS in the first full year following CP’s acquisition of control of KCS, and is expected to generate double-digit accretion upon the full realization of synergies thereafter.

To fund the stock consideration of the merger, CP will issue 44.5 million new shares. The cash portion will be funded through a combination of cash-on-hand and raising approximately $8.6 billion in debt, for which financing has been committed. As part of the merger, CP will assume approximately $3.8 billion of KCS’ outstanding debt. Following the closing into trust, CP expects that its outstanding debt will be approximately $20.2 billion.

Pro forma for the transaction, CP estimates its leverage ratio against 2021E street consensus EBITDA to be approximately 4.0x with the assumption of KCS debt and issuance of new acquisition-related debt. In order to manage this leverage effectively, CP will be temporarily suspending its normal course issuer bid program, and expects to produce approximately $7 billion of levered free cash flow (after interest and taxes) over the next three years. CP estimates its long-term leverage target of approximately 2.5x to be achieved within 36 months after closing into trust. The combined company will remain committed to maintaining strong investment grade credit ratings while continuing to return capital for the benefit of shareholders.

Two-Step Process to Complete Transaction and Merger

CP’s ultimate acquisition of control of KCS’ U.S. railways is subject to the approval of the U.S. Surface Transportation Board (“STB”).

First, CP will establish a “plain vanilla”, independent voting trust to acquire the shares of KCS. Upon shareholder approval of the transaction, and satisfaction of customary closing conditions, CP will acquire KCS shares and place them into the voting trust. This step is currently expected to be completed in the second half of 2021, at which point KCS shareholders will receive their consideration.

CP’s placement of KCS shares into the voting trust will insulate KCS from control by CP until the STB authorizes control. KCS’ management and Board of Directors will continue to steward the company while it is in trust, pursuing KCS’ independent business plan and growth strategies.

The second step of the process is to obtain control approval from the STB and other applicable regulatory authorities. The STB review is expected to be completed by the middle of 2022. Upon obtaining control approval, the two companies will be integrated, unlocking the benefits of the combination.

Board, Management, and Headquarters

Following STB approval of the transaction, CP will acquire control of KCS and Mr. Creel will serve as the Chief Executive Officer of the combined company. The combined entity will be named Canadian Pacific Kansas City (“CPKC”).

Calgary will be the global headquarters of CPKC, and Kansas City, Mo. will be designated as the U.S. headquarters. The Mexico headquarters will remain in Mexico City and Monterrey. CP’s current U.S. headquarters in Minneapolis-St. Paul will remain an important base of operations.

Four KCS Directors will join CP’s expanded Board at the appropriate time, bringing their experience and expertise in overseeing KCS’ multinational operations.

Advisors

BMO Capital Markets and Goldman Sachs & Co. LLC are serving as financial advisors to Canadian Pacific. Sullivan & Cromwell LLP, Bennett Jones LLP and the Law Office of David L. Meyer are serving as legal counsel. Creel-García-Cuéllar, Aiza y Enríquez, S.C. are serving as Mexican legal counsel to Canadian Pacific. Evercore is serving as the Canadian Pacific Board’s financial advisors and Blake, Cassels & Graydon LLP is serving as the Board’s legal counsel.

BofA Securities and Morgan Stanley & Co. LLC are serving as financial advisors to Kansas City Southern. Wachtell, Lipton, Rosen & Katz, Baker & Miller PLLC, Davies Ward Phillips & Vineberg LLP, WilmerHale, and White & Case, S.C. are serving as legal counsel to Kansas City Southern.

Comments

Post a Comment