US Customs Intensifies Inspections on Chinese E-commerce Shipments - End Age of Cheap Ecommerce from China

CBP and DeMinimus Shipping from China

The articles discuss recent changes and proposed legislation affecting the "de minimis" exemption under Section 321 of the Tariff Act of 1930, which allows goods valued at less than $800 to enter the United States duty-free when shipped to individual consumers. Key points include:

1. U.S. Customs and Border Protection (CBP) has intensified inspections on Chinese e-commerce shipments, leading to delays and disruptions for major retailers like Shein and Temu.

2. The crackdown has revealed illegal items such as fentanyl, drug-making equipment, and misdeclared values to meet the de minimis threshold.

3. The de minimis exemption has led to a surge in low-value shipments from China, with lawmakers questioning its impact on American competitiveness, consumer safety, and human rights.

4. Proposed legislation, such as the Import Security and Fairness Act, aims to eliminate the tariff exemption for countries like China and Russia, which are considered nonmarket economies and listed on the USTR's Priority Watch List.

5. The Act would also require CBP to collect information on every de minimis shipment entering the U.S., regardless of the country of origin, potentially increasing administrative burdens and compliance costs for importers and small businesses.

6. Supporters argue that changes are necessary to address the influx of illegal and harmful goods, while opponents claim that restricting the exemption would make purchases more expensive for American consumers.

7. The proposed changes to the de minimis exemption are part of a broader focus on customs modernization and U.S.-China trade relations, with additional legislation expected to address economic and national security concerns.

Additionally, the articles discuss how CBP is leveraging artificial intelligence to enhance its capabilities in screening and inspecting cargo, baggage, and shipments at ports of entry. AI is being used for object detection, anomaly detection, and automation to increase efficiency, reduce cognitive burden on CBP personnel, and improve security.

Artificial Intelligence Applied

U.S. Customs and Border Protection (CBP) has been actively integrating artificial intelligence (AI) to support its mission across various domains. Some key applications of AI by CBP and its vendors include:

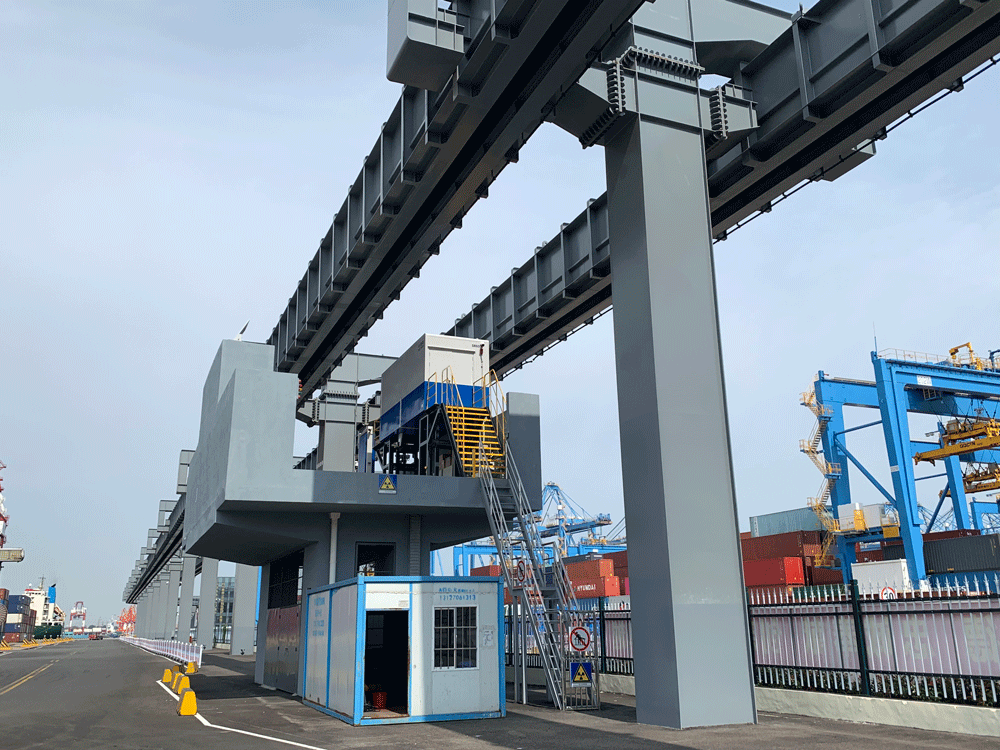

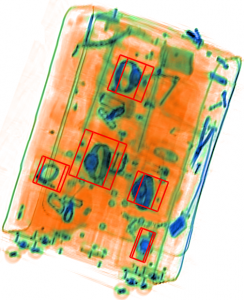

1. Non-intrusive inspection (NII) technology: AI has been integrated into NII systems to automatically identify specific objects, abnormalities, radioactive materials, and goods like tobacco or liquor bottles within seconds. This technology can be customized to detect specific commodities and smuggling trends.

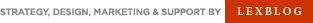

2. En-route screening: AI-powered automatic detection systems enable 100% screening of seaborne containers and breakbulk cargo without disrupting travel or trade. This is achieved by installing modular high-energy inspection systems along sky rails or mounting them on automated guided vehicles (AGVs).

3. Baggage screening: CBP has integrated AI solutions, scanners, RFID seals, and CCTV to screen all checked baggage at airports. Suspicious baggage is automatically labeled with an RFID seal, triggering an alarm when the passenger goes through Customs, while low-risk baggage allows passengers to proceed without interruption.

4. Image analysis: AI assists image analysts in identifying objects, measuring their volume, and providing useful data such as the number, size, and weight of items in a cargo consignment within seconds. This reduces the time and labor required for image analysis and allows operators to focus on critical decision-making.

5. Anomaly Detection Algorithms (ADA): Pangiam, a trade and travel technology company, was awarded a prime contract by CBP to develop and implement ADA. In partnership with West Virginia University, Pangiam will leverage its AI, computer vision, and machine learning expertise to deliver solutions that support CBP's border and national security missions.

6. Pangiam Bridge: Pangiam launched this AI-driven solution for customs authorities worldwide to automate portions of the customs inspection process for baggage, conveyances, and containers.

These AI applications aim to make CBP's operations more effective, efficient, and robust by enhancing security, facilitating trade, and reducing the cognitive load on CBP personnel. The agency continues to explore new ways to leverage AI and other advanced technologies to fulfill its mission and maintain its position as a thought leader among customs authorities worldwide.

US Customs Intensifies Inspections on Chinese E-commerce Shipments

The recent surge in scrutiny of e-commerce shipments from China by US Customs and Border Protection (CBP) has led to significant airport congestion, delays, and the suspension of several flights, particularly affecting major e-commerce players like Shein and Temu.

The crackdown has led to significant operational disruptions. “All freighters coming into LAX from mainland China, many carrying shipments from Shein and Temu, are being sent directly to Customs warehouses for full inspection,” said a source at LAX. These inspections have revealed numerous illegal items, including fentanyl, drug-making equipment, and misdeclared values to meet the de minimis threshold.

The resulting backlog has caused congestion at customs warehouses and delays in processing e-commerce shipments. With an estimated 100 freighters a day carrying around 100 tons of e-commerce cargo each, the inspection process is considerable. As a result, some planned high-frequency flights into Chicago and New York have been suspended.

A large forwarder confirmed that CBP is scrutinizing documentation and cargo descriptions “very closely,” signaling an effort to tighten controls. Sources indicate that while shipments from Hong Kong are not being checked, the US focus remains on flights from mainland China.

The Complexity Behind the Crackdown

Contrary to assumptions of a sudden protectionist move by the US government against Chinese e-commerce giants, the reality is rooted in the enforcement of existing trade regulations. Specifically, Section 321 of the Tariff Act of 1930 (Smoot-Hawley) exempts shipments valued at or below a certain threshold from duties and formal entry requirements. This threshold was raised from $200 to $800 by the Trade Facilitation and Trade Enforcement Act of 2015 (TFTEA), signed into law by President Obama in 2016, aiming to facilitate trade and simplify customs procedures.

However, other countries have moved in the opposite direction, reducing de minimis values to subject more low-value shipments to duties and taxes, leveling the playing field with domestic retail channels.

Entry Type 86 and Its Implications

The introduction of Entry Type 86 in the Automated Commercial Environment (ACE) in September 2019 allowed for the filing of Section 321 datasets within 15 days of arrival. Earlier this year, CBP highlighted enforcement challenges with low-value shipments under this entry type, including the importation of illicit substances like fentanyl, counterfeits, intellectual property rights violations, and goods made with forced labor. Violations uncovered included entry by unauthorized parties, incorrect cargo manifesting, misclassification, misdelivery, undervaluation, and improperly executed powers of attorney.

To address these challenges, CBP announced that starting February 15, customs brokers must file complete, accurate, and timely data sets, including full product descriptions and HS codes, at or before the arrival of goods.

Industry Response and Future Outlook

The intensified inspections have created nervousness within the air cargo industry. “Temu has a lot of capacity booked until the end of the year, and they’re starting to get very nervous about that,” commented a charter broker. The uncertainty has led some mainland Chinese carriers to temporarily halt freighters to ensure shipments are fully checked before departing for the US.

Carriers such as CMA CGM Air Cargo, which planned to begin flights from China to the US, may have to delay their launches. Sources suggest that the US is unlikely to cease these thorough inspections soon, especially after discovering fentanyl and drug-making equipment.

US Air Forwarders Association executive director Brandon Fried warned that the government’s focus on preventing the import of illegal drugs or their components could lead to 100% screening of all inbound shipments, effectively causing further delays and congestion. He urged the government to find alternative methods to address these issues.

The broader question for US air logistics remains whether these illegal shipments will lead to additional screening measures for all inbound cargo. With fentanyl causing the deaths of 200 Americans daily in 2022 and over a quarter of a million fatalities since 2018, the urgency for effective enforcement is high.

As the situation evolves, the industry anticipates potential adjustments to compliance procedures to mitigate delays while ensuring security. The outcome will significantly impact e-commerce platforms, logistics providers, and customs brokers handling low-value shipments into the US.

How Chinese retailers can offer Americans steep bargains on clothes and why that could change

WASHINGTON (AP) — As a substitute teacher in her mid-20s, Lindsey Puls was delighted to discover the fashion world of Shein more than 10 years ago, lured in by its super-low prices — with tops selling for a few dollars, dresses under $10, and free shipping on orders over $29.

Puls, who has a blog called “Have Clothes, Will Travel,” joined other influencers in modeling her low-priced but trendy purchases on social media like Instagram and TikTok, contributing to a surge in popularity for Shein. The company, which was founded in China and sells clothing manufactured there, is now the top fast fashion retailer in the U.S.

“From my experience, they have pretty good designs for the price and extensive varieties,” said Puls, who lives in Shiocton, Wisconsin. “The U.S. is in this phase where ‘more is better.’ Many people want to get as much clothing as money can buy.”

How can stylish imports from the other side of the Pacific be so cheap? The answer has much to do with a trade rule known as the de minimis exception, which allows parcels valued under $800 to enter the U.S. duty-free per person per day.

With the explosion of global online shopping, that rule is now coming under scrutiny. While America’s Gen Z shoppers may celebrate their online bargains, lawmakers from both parties are questioning whether the rule allows manufacturers to avoid tariffs aimed at protecting American companies and bypass laws barring the imports of products made by forced labor, illicit drugs or unsafe materials.

On Thursday, a group of 40 lawmakers asked Homeland Security Secretary Alexander Mayorkas to crack down on the de minimis trade, which they said also facilitates the flow of deadly drugs like fentanyl into the U.S.

Rep. Earl Blumenauer of Oregon, top Democrat on the House Ways and Means trade subcommittee, has introduced legislation to exclude non-market economies like China from the rule. A bill introduced in the Senate would make the practice reciprocal. China, for example, sets the de minimis threshold at about $7.

“The de minimis loophole is a threat to American competitiveness, consumer safety and basic human rights,” Blumenauer said in December.

But the de minimis rule also has powerful defenders. The National Foreign Trade Council, whose members include major shippers such as FedEx, UPS and DHL as well as online retailers like Amazon and eBay, argue that restricting its use would make purchases more expensive for American consumers and small businesses. The cost of a $50 package would double, according to the council.

Shein, now based in Singapore, said in a statement it has made it a priority to comply with the customs and import laws of the countries where it operates, including the U.S. requirements for de minimis packages.

Introduced in 1938, the de minimis exception was intended to facilitate the flow of small packages valued at no more than $5, the equivalent of about $106 today. The threshold increased to $200 in 1994 and $800 in 2016. At the time, Sen. John Thune, a South Dakota Republican, said the bill would “empower more Americans to engage in global commerce.”

In 2023, for the first time, more than 1 billion de minimis packages came through U.S. customs, up from 134 million packages in 2015. China is the biggest source of retail packages entering the U.S., accounting for the bulk of the nearly 3 million small parcels that come through every day under the de minimis rule, according to Customs and Border Protection data.

“That’s approximately a 646% increase over just eight years,” said LaFonda Sutton-Burke, director of field operations for Custom and Border Protection’s Chicago field office, which oversees one of the nation’s busiest ports for de minimis parcels. Behind the surge is the explosive growth in e-commerce, she said.

A June 2023 report by the House Select Committee on China’s Communist Party found that Shein and Temu, a low-cost online retailer of clothing and household goods, alone accounted for more than 30% of all packages shipped to the U.S. daily under the de minimis exemption.

China’s exports grew only 0.6% last year, but the bright spot was cross-border e-commerce, which includes but is not limited to the de minimis packages. These online sales expanded nearly 20% in 2023 to reach 1.83 trillion yuan, or $257 billion, nearly 8% of the country’s total exports. The U.S. is the biggest market, accounting for more than a third of Chinese goods bought online and shipped internationally in 2022, the last year for which China’s official customs data are available.

The United States does not include these direct online retail sales in its import figures, so it is difficult to know the true dollar value of the de minimis parcels. Charles Benoit, trade counsel for the Coalition for a Prosperous America, said an estimated $188 billion worth came into the U.S. from other countries in 2022.

A repeal of the provision could add $20 to $30 to each transaction, which would make it financially impossible for businesses such as Shein and Temu to sell to American consumers at the low prices they are offering now, Benoit said.

In a January meeting with Mayorkas, the National Council of Textile Organizations complained about unfair trade practices, including the de minimis rule.

“The industry has lost eight plants in three months,” the council said. “Plants that survived the Great Depression, the Great Recession and COVID aren’t surviving the economic environment due to demand destruction exacerbated by unfair trade practices.” It called for better enforcement of laws forbidding the import of goods produced by forced labor and the closing of the de minimis loophole, which it said “is facilitating millions of unchecked packages a day into our market and hurting our industry.”

Law enforcement agencies also complain about the de minimis provision, which they say has helped fuel the drug crisis.

The National Association of Police Organizations testified in December before the House Ways and Means trade subcommittee that much of the fentanyl seized last year came into the country in de minimis packages. It is unclear how much fentanyl and other illicit drugs may be slipping undetected into the country in the small packages.

On a recent Friday morning at Chicago’s O’Hare airport, small parcels that had arrived by mail from overseas were on conveyor belts going through X-ray machines for inspection. Officers occasionally stopped the belt to pick out and open a suspicious parcel. Among the items they seized were replica guns and illicit drugs.

Sutton-Burke said Customs and Border Protection uses a “layered security approach” and works with multiple partners to manage shipments, but resources have “literally remained static” in the face of explosive growth of de minimis parcels.

Investments in infrastructure and technology would be helpful, she said, as would updating U.S. rules and laws to allow the agency to obtain more information about the small parcels coming in to help customs agents identify high-risk shipments.

___

Videojournalist Melissa Perez Winder in Chicago and business writer Haleluya Hadero in New York contributed to this report.

China e-commerce shipments would lose US tariff exemption under proposed law

Item 1 of 2 A keyboard and a shopping cart are seen in front of a displayed Shein logo in this illustration picture taken October 13, 2020. REUTERS/Dado Ruvic/Illustration

[1/2]A keyboard and a shopping cart are seen in front of a displayed Shein logo in this illustration picture taken October 13, 2020. REUTERS/Dado Ruvic/Illustration Purchase Licensing Rights, opens new tab

NEW YORK, June 14 (Reuters) - A bipartisan group of U.S. lawmakers planned to introduce a bill on Wednesday to eliminate a tariff exemption widely used by e-commerce sellers to send orders from China to U.S. shoppers, one of the sponsors said.

The exception, known as the de minimis rule, exempts imports valued at $800 or less from tariffs if the items are shipped to individual consumers. The bill would ban such shipments from China immediately upon enactment, sponsor Republican Senator Bill Cassidy said.

Ecommerce sellers such as China-founded, Singapore-based Shein and Temu, a rival owned by PDD Holdings Inc

(PDD.O), opens new tabthat operates the Chinese ecommerce site Pinduoduo, are big beneficiaries of the exemption. A federal brief in April said the companies “exploit” de minimis to avoid duties and import illegal items such as those made in China's Xingiang region with forced Uyghur labor.

A Shein spokesperson said Tuesday the company has no manufacturers in Xinjiang. Temu did not immediately respond to a request for comment.

De minimis shipments have drawn attention at least since 2019, when the U.S. Consumer Product Safety Commission reported it struggled to catch unsafe imports because of the heavy volume of low-value packages. Such shipments rose to 685.5 million in 2022 compared with 410.5 million in 2018, U.S. customs data showed.

The bill’s other sponsors are Republican Senator J.D. Vance and Democratic Senator Tammy Baldwin. It was unclear how much traction the proposal would gain. A separate but similar bill by Democratic Representative Earl Blumenauer failed to pass Congress last year.

Under the bill, countries other than China and Russia could keep the exemption by adopting the $800 threshold for their own tariff-free imports. The bill would only allow private shippers like FedEx

(FDX.N), opens new tab, UPS

(UPS.N), opens new taband DHL to transport de minimis packages and exclude postal services.

Coming soon: Get the latest news and expert analysis about the state of the global economy with Reuters Econ World. Sign up here.

Reporting by Katherine Masters; Editing by Cynthia Osterman

Our Standards: The Thomson Reuters Trust Principles., opens new tab

Changes To “De Minimis” Shipping Will Likely Have Effects Beyond China And Russia

Changes may be coming to the “de minimis” exception under Section 321 of the Tariff Act of 1930, as amended, which allows goods valued less than $800 to enter the United States free of duty and taxes, and generally free from formal review, when shipped to individual consumers.

Senators Sherrod Brown (D-OH) and Marco Rubio (R-FL) and Representatives Neal Dunn (R-FL) and Earl Blumenauer (D-OR) introduced the Import Security and Fairness Act (“the Act”) on June 15, 2023, the most recent of several legislative efforts proposing changes to the “de minimis” threshold. The Act would make goods sourced from perceived adversarial nations ineligible for de minimis treatment under Section 321 of the Tariff Act of 1930, as amended. Specifically, the Act targets countries that are both (i) a nonmarket economy (as defined by the Tariff Act) and (ii) listed on the United States Trade Representative’s (USTR) Priority Watch List. Notably, as of June 2023, only China and Russia meet both criteria. Accordingly, in practice, the Act would require a formal importation process for all small Chinese and Russian goods, likely exacting a heavy toll on top of the existing Uyghur Forced Labor Prevention Act (UFLPA) and U.S. sanctions regimes.

However, the Act would affect all “de minimis” shippers, despite its emphasis on China and Russia. Under section three of the Act, Customs and Border Protection (CBP) would be required to collect information on every de minimis shipment entering the United States, regardless of their country of origin, under new regulations to be promulgated by the Treasury Department. Collected information would include a shipment’s description of goods, transactional value, and the identity of the shipper and importer, among other requirements. The Act would also impose civil penalties ranging from $5,000 to $10,000 for violations of reporting requirements.

Some importers and small and medium-sized enterprises have expressed concern about these proposed changes. At a February 2023 Senate Finance Committee hearing on trade modernization, private sector witnesses defended the existing de minimis exception, and argued that changes to de minimis rules would unduly burden their businesses.

However, UFLPA and recent congressional rhetoric on China demonstrate considerable momentum and appetite to increase administrative burdens on Chinese imports that may outweigh these concerns. Moreover, since CBP’s April 2023 Trade Facilitation and Cargo Security Summit, which featured several discussions on the potential for illicit goods to enter the United States and data on the uptick in de minimis shipments from China, many lawmakers have grown to perceive de minimis shipping as a necessary and uniquely Chinese loophole to close.

For reference, Congress increased the current de minimis threshold from $200 to $800 under the Trade Facilitation and Trade Enforcement Act of 2015 (TFTEA). Following the change, the volume of de minimis shipments increased from approximately 410 million shipments in fiscal year (FY) 2018 to approximately 771 million shipments in FY 2021. De minimis imports from China accounted for the majority of this growth, including more than 446 million shipments in FY 2021 alone.

The Act’s introduction also precedes long-awaited legislative proposals on customs modernization and US-China trade. Anticipated legislation includes the 21st Century Customs Framework and the anticipated China Competition Bill 2.0, led by Senate Majority Leader Chuck Schumer (D-NY) and Senate Democrats. While the China Competition Bill 2.0 is expected to focus on stemming the flow of US advanced technology and investments to China, the legislation is also likely to contain significant provisions on economic and national security competition.

Implications for businesses go beyond a potential increase in duties on imports from de minimis shipments. As noted above, data collection from importers writ large will likely increase, increasing overall record keeping and compliance costs. Further, utilization of limited U.S. Customs Service resources to collect data on small imports could lead to greater systemic inefficiencies overall. Finally, Congressional interest to stem imports from China and Russia is likely to continue, raising the possibility of additional burdens or restrictions placed on imports from these nations in the future.

Customs brokers under scrutiny as US CBP confirms ecommerce crackdown - The Loadstar

© William Perry

US Customs and Border Protection has confirmed that it is cracking down on ecommerce, to ensure all small packages are compliant with US law. Customs brokers are under particular focus.

A statement released earlier by CBP acting commissioner Troy Miller noted that the agency was “taking action to ensure compliance and minimize the exploitation of the small package, or de minimis, environment.”

He continued: “While the majority of brokers, carriers, and supply chain businesses that participate in CBP’s Entry Type 86 Test are compliant with applicable laws, we are enhancing our enforcement efforts to ensure that all participants are held accountable when they are not.

“To date, CBP has suspended multiple customs brokers from participating in the Entry Type 86 Test after determining that their entries posed an unacceptable compliance risk.”

Seko Logistics is the only company so far publicly named for being suspended from Entry Type 86 activities, after it sent a letter to customers. Seko has not responded to requests for comment, but told customers it was “incredibly disappointed by this unfortunate decision”.

It added that it had a 99.999% compliance rate, and claimed it had only been given a week to address any possible issues. “We intend to press for reinstatement as soon as possible.”

The CBP’s statement clarified: “Any broker that has been suspended will be considered for reinstatement if it demonstrates to CBP that it has developed and implemented a remedial action plan.”

With the strict inspection of shipments and documents now in place, in particular from freighter flights originating in mainland China, according to sources, congestion is said to be building at Customs warehouses such as LAX. The crackdown has also led to a nervy air cargo market on both sides of the Pacific, with some flights and charters paused.

Sources said the CBP had found multiple illegal shipments, which have now been seized.

CBP’s statement said: “CBP’s evaluation and suspension of non-compliant Entry Type 86 Test participants is part of a multi-layered enforcement approach to prevent abuse of the de minimis process, protect the integrity of the supply chain, and ensure that businesses comply with applicable US legal requirements.

“When businesses fail to comply with US law, it can have far-reaching effects on the integrity of our trade system and the people reliant on the goods that flow through our ports every day.

“For example, bad actors are exploiting the de minimis environment to move materials used to produce synthetic drugs — like fentanyl and its analogues — and other contraband into the United States. CBP’s enforcement efforts to disrupt illicit activities begin beyond our borders, and we will continue to strengthen our ability to combat de minimis shipment exploitation in a multitude of ways.

“CBP remains dedicated to protecting American consumers, industries, and the integrity of our trade system. We will work closely with all businesses and stakeholders to ensure such protection continues by continuing to take enforcement action against those who abuse the Entry Type 86 Test or otherwise abdicate their customs compliance responsibilities.”

CBP E-Commerce Strategy

E-Commerce is a growing segment of the U.S. economy and has been for the past several

decades. U.S. Customs and Border Protection (CBP) must adapt to the changing ways

business is conducted due to the growth of low-value packages, which e-commerce

primarily drives. CBP’s E-Commerce Strategy strengthens its ability to protect the health

and safety of American citizens and the U.S. economy from non-compliant goods.

In this strategy, CBP defines e-commerce as high-volume, low-value shipments entering

the port limits of the United States.

Artificial Intelligence to Harness Key Insights at CBP

Release Date

Fri, 03/24/2023

Data is an asset to the U.S Customs and Border Protection’s (CBP) mission and effectively harnessing key insights that this data offers in a timely fashion provides immense value for the safety of the nation and the ability to fulfill CBP’s mission.

To achieve this enormous task, CBP has embraced the integration of Artificial Intelligence (AI) to directly support fulfilling its mission across the enterprise. The Office of Information and Technology operates to provide IT products and services faster, better, more affordably and more securely at the speed of CBP’s 24/7 mission. The Office of Information and Technology implemented the enterprise AI Machine Learning Center of Excellence to lead strategic transformation, tactical mission operations excellence and innovation with data for CBP’s daily mission in multiple use cases, while seeking to establish commensurate governance and ethical oversight approaches in this new, powerful technology.

We are working to evolve CBP to a more data-driven organization where

CBP is rapidly expanding and accelerating the operational use of AI

smartly across the entire agency to achieve real mission outcomes guided

by responsible AI principles.

Artificial Intelligence Center of Innovation

In 2022, the CBP established the AI Center of Innovation to rapidly build a scalable foundation that leverages AI and exploits the terabytes of data CBP captures for its toughest mission problems. Partnering with the larger AI community, to include industry, academia, other government organizations, the CBP team of data scientists and data engineers works closely across CBP to assess technologies, processes, and tools that support data enrichment, annotation, ecosystem, and AI solutions that can be scaled for the CBP enterprise. For example:

- Video and image redaction. Building object detection models to automatically identify frames where objects are detected, label the detected object, and perform redaction on frames that contain sensitive information (e.g., personally identifiable information).

- Object identification in streaming video. Deployment of AI models to cameras to automatically detect and track after-hours activities, providing real-time alerts to operators and increasing the effectiveness of existing surveillance platforms and decreasing cognitive load of CBP personnel.

- Increased efficiency and throughput. Better detection by reducing false positives for inspection. Deployment of AI models to assist CBP officers screening for contraband and anomaly detection in passenger vehicles and cargo conveyances.

- Data categories and labels. Data annotation provides data with contextual elements like categories and labels, which machines can read and act upon to produce higher-quality results for search queries and analysis.

People are at the core of CBP’s mission prioritize “Responsible AI,” which means employing AI in a manner that respects human dignity, rights, and freedoms. CBP provides appropriate transparency regarding our AI methods, applications, and use. We develop and employ best practices for maximizing reliability, security, and the accuracy of AI design, development, and use.

Leveraging AI is a CBP journey that requires both short- and long-term strategies, and CBP is working to ensure that today’s technologies are used to prepare for tomorrow’s system enhancements and mission needs.

The AI revolution is underway, and this is good news for Customs

Customs authorities are showing a growing interest in adopting artificial intelligence (AI), the broad category of science that entails simulating human thinking capability and behaviour. As stated in a joint paper published by the World Customs Organization, (WCO) and the World Trade Organization (WTO) entitled The role of advanced technologies in cross-border trade: A Customs perspective, “around half of Customs authorities use some combination of big data analytics, AI and machine learning, while the other half plans to do so in the future.”

AI has become one of the most transformative technologies for Customs, acting as a force multiplier to help it navigate challenges such as strained human resources and supply chain vulnerabilities, as well as security and revenue risks posed by the flow of goods generated by online sales.

Automated detection tools

AI holds the key to ushering Customs into a new era of automation and efficiency. Among other things, AI has become an integrated part of non-intrusive inspection technology and helps Customs officers identify specific objects, abnormalities, radioactive materials, and goods such as tobacco or liquor bottles, within seconds. The list of items which can be identified automatically with threat recognition technology is ever expanding, and the technology can be tailor-made to address specific commodities and smuggling trends.

During tests under real operating conditions conducted by China Customs, Tsinghua University and NUCTECH, a total of 1,182 types of goods were effectively identified by non-intrusive inspection (NII) systems equipped with AI. Among them, 49 were restricted and prohibited items.

Streamlining en-route processes

For seaborne containers, such automatic detection offers opportunities in transforming Customs inspection into a streamlined en-route process, significantly increasing inspection rates without disrupting travel or trade. Take the Port of Qingdao in China, for example, where a sky rail is used to transport containers. A modular high-energy inspection system scans every container transported along the rail route. In a field where time is money, the solution not only enables significant time savings and comprehensive security vetting, but also slashes the cost of container dispatching by 100 US dollars per container.

En-route screening can also be applied to breakbulk cargo provided the vehicle transporting the cargo passes through a scanning device along its way. This will be the case in one automated port terminal expected to be operational soon, where NII systems are being mounted on automated guided vehicles (AGVs), the name given to material handling systems or load carriers that travel autonomously throughout a warehouse, manufacturing facility or port without an onboard operator or driver.

Automatic threat detection systems also make 100% screening of inbound baggage a reality. They enhance security and improve travel experiences. Customs in China and Thailand, for instance, have integrated AI solutions, scanners, radio frequency identification (RFID) seals and closed-circuit television (CCTV) altogether to drive informed decision-making in a highly efficient manner. All checked baggage is screened, scanned and monitored before being conveyed to carousels at airport baggage reclaim areas. Suspicious baggage is automatically labelled with an RFID seal which triggers an alarm when the passenger goes through Customs. Those particular passengers are stopped for further scrutiny, while those with baggage deemed as low risk can breeze through exits without any interruption to their free movement.

Empowering staff

Image analysis can be a repetitive and tedious task. During a trial contest organized between humans and machines, the latter outmatched human operators in terms of positive detection rates. Only seasoned experts with over 10 years’ experience were able to perform a little bit better than the machines. On average, it took human operators 45 times longer to analyse an image.

AI could offer efficient support to image analysts, especially those with little experience, and reduce the time required for such analysis. With AI as an assistant, operators could work without feeling the usual fatigue that the job entails, and focus on critical decision-making. In short, the image analysis process would be improved, shorter and less labour-intensive.

Apart from identifying items, AI can also help Customs obtain useful data such as the number of items in a cargo consignment, as well as their size and weight, within seconds.

With expertise derived from 1,000-plus AI-powered deployments, we believe that AI is finding its way into all the critical aspects of Customs control, thereby making the latter more effective, efficient and robust.

More information

chenzhiqiang@nuctech.com

www.nuctech.com

About the author

Professor Zhiqiang Chen is a researcher working on radiation imaging at Tsinghua University (Beijing), while also serving as the Chairman and President of NUCTECH. With the aim of bringing technology to life, he has steered the NUCTECH team towards rolling out cutting-edge inspection technology in various fields, including Customs controls and airport security. Under his leadership, NUCTECH has evolved from a small company into a global business with over 50,000 scanners and solutions deployed in more than 170 countries.

U.S. Customs and Border Protection has awarded Pangiam with a Prime Contract for Anomaly Detection Algorithms

, /PRNewswire/ -- Pangiam (www.pangiam.com), a leading trade and travel technology company, was awarded a prime contract to develop and implement Anomaly Detection Algorithms (ADA) by U.S. Customs and Border Protection (CBP). In partnership with West Virginia University, Pangiam will leverage its artificial intelligence, computer vision and machine learning expertise to deliver an important tool to support CBP's critical border and national security missions.

In May, Pangiam launched Pangiam Bridge, a cutting-edge artificial intelligence driven solution for customs authorities worldwide. Pangiam Bridge will allow customs officials to automate portions of the customs inspection process for baggage, conveyances, and containers. Pangiam has partnered with West Virginia University to conduct research and develop new, cutting-edge artificial intelligence, machine learning and computer vision technologies for commercial and government applications.

"CBP has taken a thoughtful and dynamic approach toward leveraging AI to fulfil its border and national security missions and continues to serve as a thought leader for customs authorities worldwide seeking to operationalize emerging technologies like AI. Pangiam looks forward to supporting CBP as it provides these solutions to the frontline operator," said Andrew Meehan, Pangiam Bridge Lead.

"The ADA project demonstrates that when government, industry and academia collaborate, we can rapidly introduce innovative technologies that positively impact real-world missions. Pangiam and West Virginia University look forward to delivering AI solutions that drive efficiency and security at the border, and we commend CBP for their vision in leveraging Commercial Solutions Opening Pilot to accelerate this program," said Brian Lodwig, Chief Growth Officer at Pangiam.

About Pangiam

We are security experts, technologists, innovators and problem solvers.

Founded by a team of customs and security professionals with decades of collective senior level executive experience, Pangiam has a deep understanding of the security, facilitation, and operational challenges facing businesses and governments today—and how they affect the customer experience, revenues, and brand loyalty. Since our founding, Pangiam has acquired industry leading technology companies in the identity verification and access control space, including veriScan, Linkware, and Trueface. Today, we operate under the Pangiam name, as a single enterprise offering comprehensive solutions, expertise and capabilities.

Pangiam Contact: media@pangiam.com

WVU Contact: wvutoday@mail.wvu.edu

SOURCE Pangiam

Comments

Post a Comment